One Person Company (OPC) Registration – Complete Information

The concept of a One Person Company (OPC) was introduced under Section 2(62) of the Companies Act, 2013 in India. It is a revolutionary move aimed at encouraging individuals who aspire to establish their own business ventures while enjoying the benefits of a corporate structure. The introduction of OPC has bridged the gap between sole proprietorship and private limited companies by creating a hybrid model that ensures full managerial control with limited liability protection.

What is an OPC?

A One Person Company is a legal entity that can be formed with just one shareholder and one nominee, unlike a traditional private limited company that requires a minimum of two shareholders and directors. An OPC allows a single person to run a company as a legal entity, distinct from its owner. This ensures continuity and protects personal assets from business liabilities.

OPC is suitable for small traders, individual consultants, freelancers, and startups who wish to operate in an organized manner, maintain credibility in the eyes of customers, and access benefits offered to registered businesses such as funding opportunities, government schemes, tax advantages, and more.

Key Features of OPC

🔹 Single Ownership

Complete control over decision-making with no interference from partners or co-directors.

🔸 Nominee Requirement

A nominee is required to ensure seamless succession in case of the owner's absence or demise.

🔹 Separate Legal Entity

The company is legally separate from its owner and can hold assets or face lawsuits independently.

🔸 Limited Liability

Protects personal assets from company liabilities, ensuring financial safety for the promoter.

🔹 Perpetual Succession

The company continues to exist even if the owner dies, thanks to the appointed nominee.

Benefits of Registering an OPC

📌 Legal Recognition

OPC offers a legally recognized structure for solo entrepreneurs and startups.

📌 Limited Liability

Personal assets are protected from business debts and liabilities.

📌 Easy Compliance

Fewer regulatory requirements compared to other company types.

📌 Access to Funds

Improves chances of getting loans and attracting investors or government schemes.

Documents Required

🪪 ID Proof

PAN & Aadhaar of the director and nominee

📷 Photographs

Recent passport-size photographs

🏠 Address Proof

Bank statement or utility bill (not older than 2 months)

📍 Office Address

Rent agreement, electricity bill & NOC from the owner

📝 Nominee Consent

Form INC-3 signed by nominee

🔐 DSC

Digital Signature Certificate for the proposed director

Eligibility Criteria

🇮🇳 Indian Resident

The director and nominee must be Indian citizens and residents.

🔁 One OPC Rule

A person can’t incorporate or be nominee in more than one OPC.

💰 Capital Requirement

Minimum authorized capital of ₹1 lakh is required (no minimum paid-up capital).

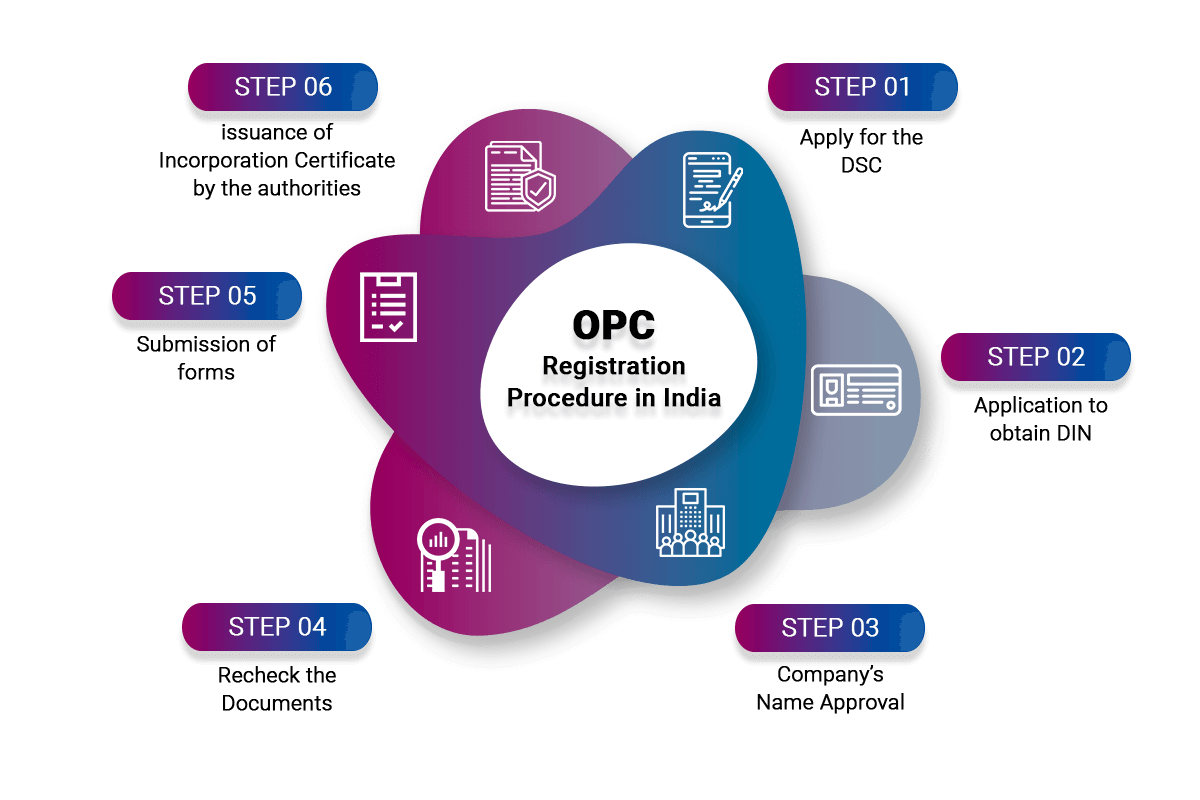

OPC Registration Process

Step 1: Obtain Digital Signature Certificate (DSC).

Step 2: Apply for Director Identification Number (DIN).

Step 3: Reserve company name through SPICe+ Part A.

Step 4: Draft incorporation documents (MOA, AOA, INC-3).

Step 5: File SPICe+ Part B form with MCA.

Step 6: Receive Certificate of Incorporation from the Registrar of Companies.